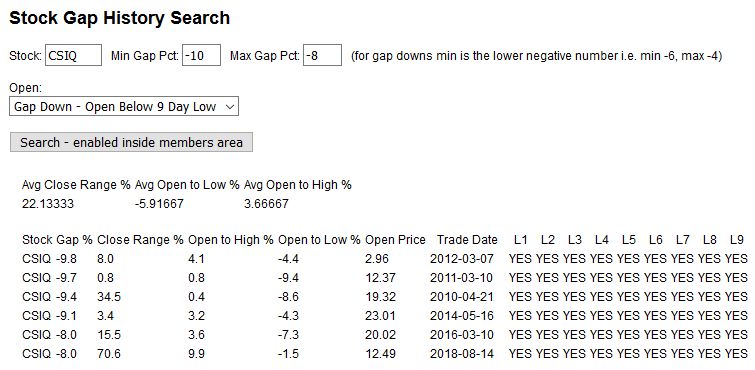

Stock Gap History Search

We start off our trading day studying stocks gapping up and down with our Stock Gap History Search tool. Individual stocks have different personalities when thay gap. This tool reveals those personalities, going back 10 years of trading history.

Our Stock Gap History Search tool takes in the values you enter for Gap Range, and gives you 4 options for prior 9 day history:

* Gap Up - Open Over 9 Day High

* Gap Up - Open Below 9 Day High

* Gap Down - Open Below 9 Day Low

* Gap Down - Open Over 9 Day Low

We offer a free 7 day trial membership to our site, which includes the Stock Gap History Search tool.

Trade Example

Take a look at the CSIQ search results below (search tool available inside our members area) with a gap down range search of -10% to -8%, gapping below the previous 9 day low. What does it reveal? Look at the Close Day Range %, all very low results on a 0 to 100 scale, and the Average Open to Low % of -5.9%, that's nice profit potential. CSIQ has shown a history of great gap-n-go stock after a gap of this type, and we use this information with our other trading rules to formulate a trading plan for the day. While this is no guarantee of a profitable trade, we wouldn't trade a gapping stock without knowing it's gap personality first.

We entered the short trade after the first 5 minutes of trading confirmed CSIQ had a

high probability of remaining weak all day (the first 5 minute bar is very bearish).

We entered the short trade at $21.00 and covered at $19.30 for a nice 8% gain.

We offer a free 7 day trial membership to our site, which includes the Stock Gap History Search tool.